Starting a business is one of the most thrilling things you can do. It’s freedom, creativity, and courage rolled into one. But it’s also unpredictable — and many people dive in excited, only to burn out or go broke because they didn’t build the right foundation.

Let’s talk about something simple but powerful: the basics of starting a business — and why your Profit and Loss statement (P&L) might just be your business’s lifeline.

💡 The Dream Is Beautiful — But the Details Matter

Picture this: you finally start that bakery, beauty studio, or online store. The first sales come in. You’re excited, maybe even a little emotional. Then months later, you can’t tell where the money went — only that it’s never enough.

That’s where most small businesses fall. It’s not passion they lack — it’s structure.

Every successful business, from your neighborhood kiosk to Apple, runs on the same fundamentals:

1️⃣ An idea that solves a problem.

2️⃣ A plan to reach customers.

3️⃣ A way to manage the money.

If you get the first two right but neglect the third — money management — your dream slowly becomes stress.

🧭 Step 1: Start Simple, but Start Right

You don’t need a fancy office or expensive branding. Here’s how to start lean but smart:

- Start with a clear offer.

What problem are you solving? For whom? Define your core product or service and who benefits most from it. - Understand your market.

Talk to real people. What do they actually need? What are they willing to pay? - Keep costs low, but don’t cut corners.

Start small. Don’t rent space before you have steady customers. Use free tools — Instagram, WhatsApp, Canva, and Google Sheets — until you can afford more. - Register your business.

Even if it’s just a sole proprietorship — it builds credibility and helps you separate personal and business money.

💰 Step 2: Why Your P&L Is Your Best Friend

A Profit & Loss (P&L) statement sounds intimidating, but it’s simply a snapshot of your business health. It shows how much money you made, how much you spent, and what’s left.

Think of it as your business heartbeat.

When you track your P&L:

- You see what’s working (which products make profit).

- You see what’s leaking money (expenses that don’t add value).

- You can make decisions with confidence, not guesses.

📊 Step 3: How to Build a Simple P&L

You can use a notebook, Excel, or Google Sheets.

Here’s the simplest way to do it monthly:

- Category

- Example

- Income

- Sales, services, commissions

- Expenses

- Rent, supplies, data, delivery, wages

- Net Profit

- Income – Expenses = 💰

💡 If your expenses exceed income for more than 3 months, it’s time to cut costs or pivot your pricing.

Pro Tip: Even if you earn irregularly, log every payment — however small. Over time, you’ll see patterns that guide smarter moves.

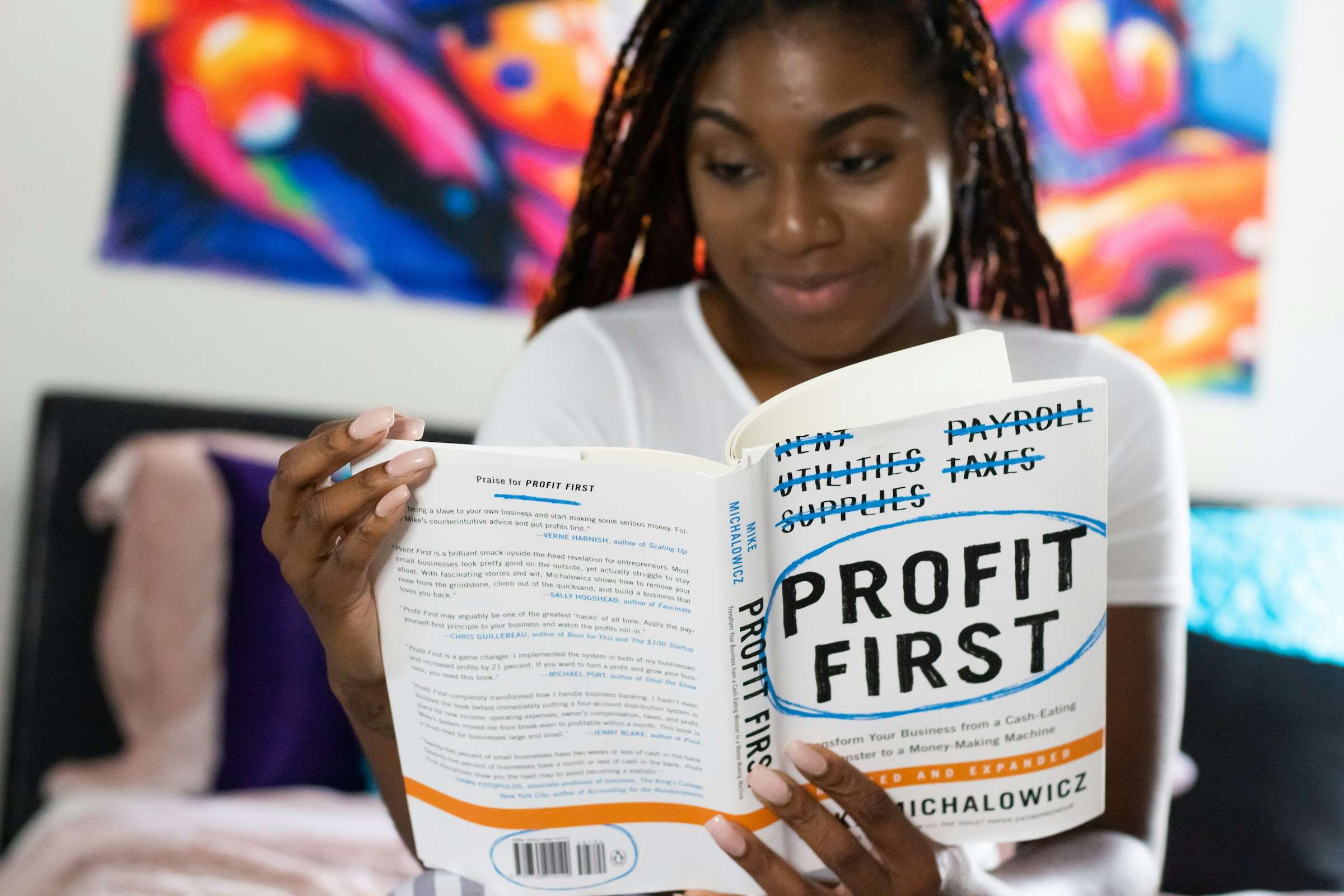

⚙️ Step 4: Manage Emotion Like a CEO

Many founders confuse sales with profit — or passion with success.

Having a P&L gives you perspective. It keeps emotions in check.

Because truthfully, numbers don’t lie. They’ll show you whether you’re growing or just busy.

🌱 Step 5: Review, Reflect, and Reinvent

Every month, sit with your numbers:

- What grew?

- What shrank?

- What can you stop spending on?

- What deserves more investment?

Those 30 minutes each month could be the difference between running a business and running in circles.

✨ Closing Thought: Starting a business doesn’t have to be complicated. But it does have to be intentional. You can’t manage what you don’t measure.

Your P&L is more than a spreadsheet — it’s your map. It shows where you are, what direction you’re going, and how close you are to the dream that started it all.

If you’ve started a side hustle or business, open a blank sheet today and write three columns: Income, Expenses, Profit. Track it for one month — just one. You’ll be amazed what you learn.